Who is Contact+?

Contact+ Insurance Network Ltd. is a Canadian brokerage, and a member of the Fairfax family. Contact+ is licensed in most provinces and territories to sell property and liability insurance. Since 1998, we have been dedicated to helping clients who require specialized property and liability coverage find the perfect policy to meet their needs.

Our Business Insurance solutions.

Contact+ started out offering Directors and Officers liability insurance, errors and omissions insurance, and bond policies for contractors. But we’ve since expanded into other markets to ensure we’re providing the most comprehensive insurance policies we can.

Here are just a few of the insurance coverages we’re now able to offer:

Commercial general liability:

Commercial general liability insurance is the cornerstone of any business’ liability coverage. It’s designed to protect businesses from a loss if they’re found legally liable for bodily injury or property damage to a third party.

Professional liability coverage:

Professional liability coverage responds to claims arising from acts of professional negligence.

Environmental coverage:

If a business may be held liable for the release or escape of pollutants, this would be the right coverage to help. It’s designed to help fill the coverage gaps created by pollution exclusions in liability and property insurance policies.

Directors and officers liability:

Directors and officers liability insurance could protect a business against costs arising out of allegations of wrongful acts and lawsuits brought against their board of directors and officers.

Why choose us?

Here at Contact+, the “plus” isn’t just for show. We really do go above and beyond to make sure our clients have coverage for anything they could possibly need. We’ve even insured pillows for cows, been approached to cover spas for horses, and been asked to cover pig manure for a renewable energy company — we don’t like saying no, so we’ll do whatever we can to get your business the coverage it needs.

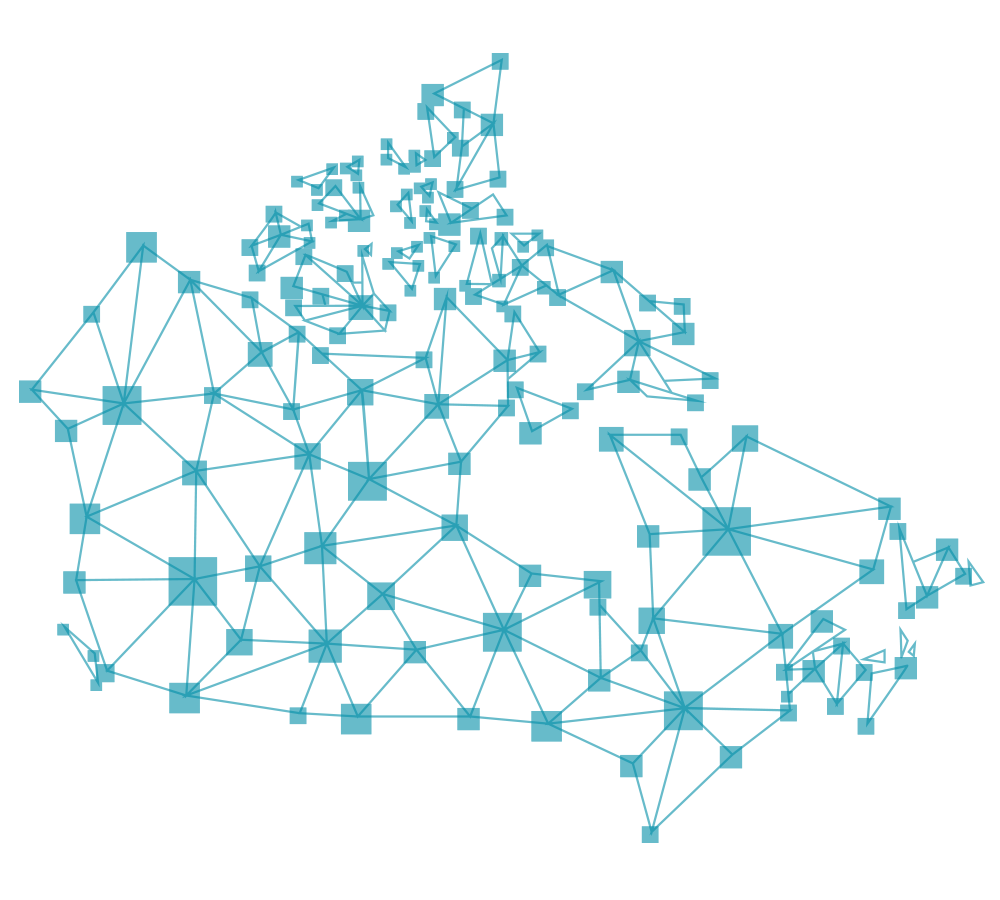

Who do we partner with?

When our clients need a policy, we utilize our many connections with insurers across Canada to make sure they get the exact coverage they need. As an independent insurance broker, our goal is to provide the most comprehensive and competitive insurance products to meet our clients’ needs.

We are an approved Lloyd’s of London coverholder and deal with a number of insurance providers, including:

Our added services.

We also provide personalized, quality service that includes professional insurance advice, ongoing policy maintenance, and claims support when needed. We are advocates for our clients and ensure we consistently represent their best interests to their insurance providers.